9:00AM To 6:00PM

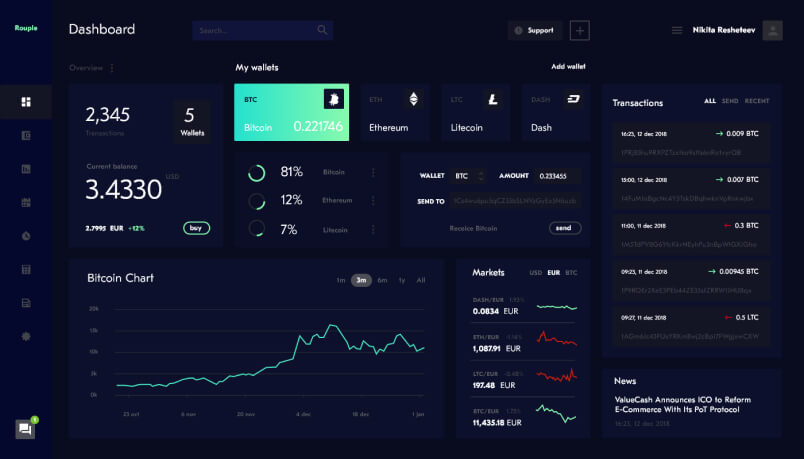

LogInYou can see a record of all your transactions anytime you want and never have to worry about someone erasing or stealing your money!

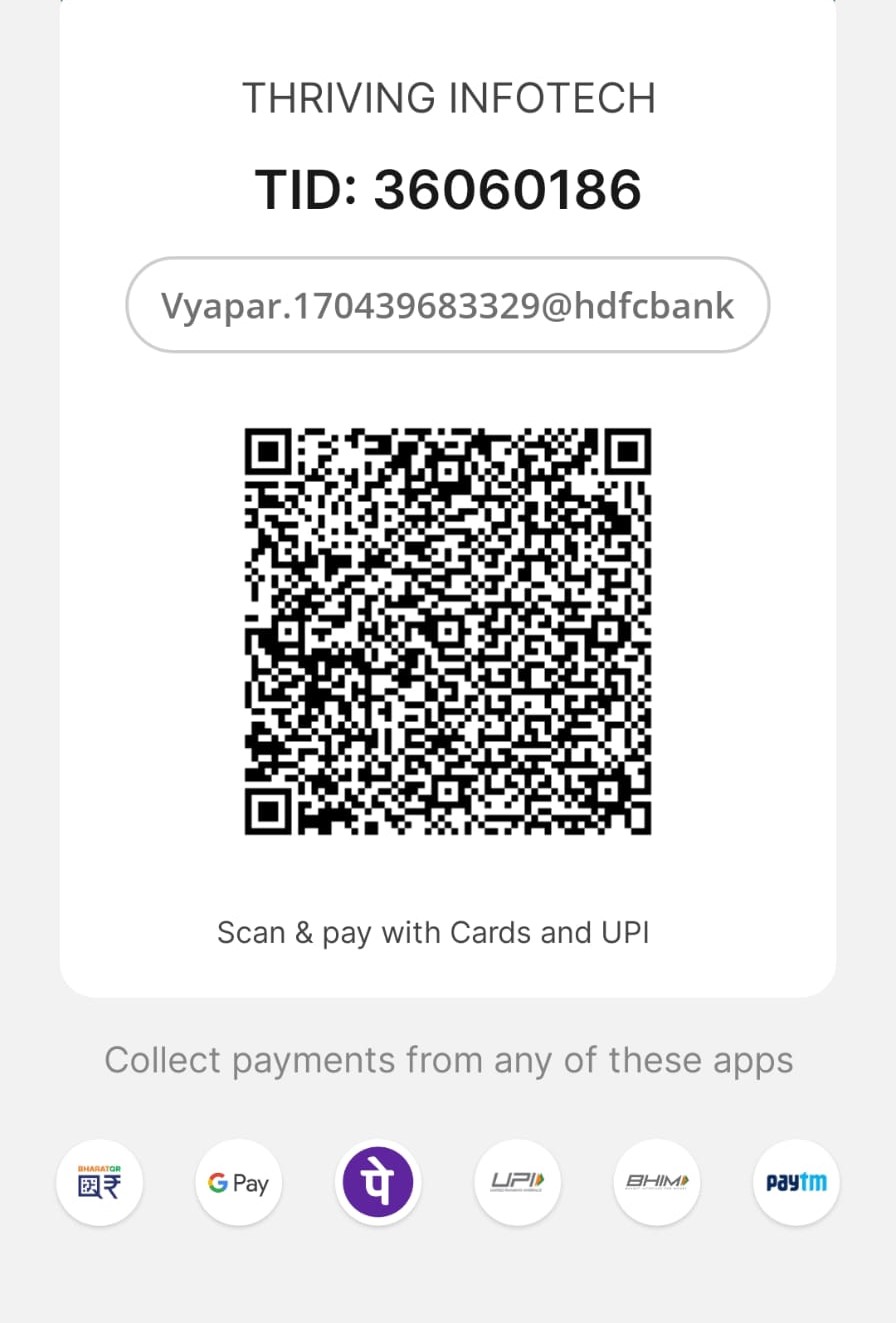

Thriving Infotech is fully automated trading Bots that can place all trade transactions without manual intervention on your own trading Account Based on the built-in strategies.

Business Experience

Many Services

Algorithmic trading automates buy/sell decisions using predefined instructions for efficiency.

Algorithmic trading relies on real-time data feeds for instant decision-making and execution of trades.

Automated trading executes buy/sell orders based on pre-set criteria for efficient market participation.

Backtesting evaluates trading strategies using historical data to assess potential profitability and risk.

Plan Your Investment & Wealth Creation Future.

Thriving Infotech specializes in algorithmic trading, leveraging cutting-edge technology and expertise to optimize strategies for profitability and risk management.

Algorithmic trading employs various strategies like mean reversion, trend following, momentum, and statistical arbitrage to automate buy/sell decisions, aiming for efficiency, profitability, and risk management in financial markets.

Mean reversion is the tendency for a variable to return to its historical average over time.

Trend following is a trading strategy that capitalizes on market momentum.

Momentum trading involves buying securities rising in price and selling those falling.

Statistical arbitrage exploits price discrepancies in financial markets using quantitative models.